Exciting Collaboration: ManjaLink and eRemit Singapore!

We’re thrilled to announce an exciting collaboration between ManjaLink and eRemit Singapore. From June 24, 2024, to December 23, 2024, get rewarded for transferring money to Malaysia or any overseas account via the eRemit Singapore app.

Exclusive Rewards for ManjaLink Users

1. Existing ManjaLink Users: Receive 15 Travel Credits for free after a valid remittance transfer has been made using the eRemit Singapore app.

2. New to ManjaLink? You will receive a special link to purchase a new ManjaLink card at 50% off after you have made a valid remittance transfer using the eRemit Singapore app.

3. Sign up here and complete your first transaction to receive a FREE T-Shirt*!

*Collection points listed here (to be announced soon)

For more information, please refer to the guidelines and Terms and Conditions below.

Terms and Conditions

The Terms and Conditions (hereafter “Terms and Conditions”) shall govern the ManjaLink and eRemit Singapore Rewards Campaign (hereafter the “Campaign”)which is organized by ManjaLink and eRemit Singapore (hereafter “Organizer”). By participating in this Campaign, Customers shall be deemed to have understood and agreed to be bound by the Terms and Conditions of this Campaign.

TERMS

Definitions & Interpretation

1. Customers are hereby considered as the user of eRemit Singapore mobile application.

2. eRemit Singapore is an online money transfer portal operated by Kliq Pte Ltd that allows the users to transfer money globally.

3. The ManjaLink Card is a contactless smart card that stores Travel Credits for payments on Causeway Link Cross-border buses (travel between Singapore and Johor Bahru, Malaysia) & selected local buses (myBAS included). ManjaLink enables cashless payments and ticketing on-board buses, and applicable for all routes connected to the 1st Link, 2nd Link and selected local routes.

4. Travel Credit (TCr) is a stored value within the ManjaLink Card. The conversion rate of the TCr depends on the currency exchange rate between Malaysia Ringgit and Singapore Dollar (Released by ManjaLink). TCr will be deducted as per bus fare.

5. The latest conversation rate is reflected at the ManjaLink website (www.manjalink.com.my). The TCr balance in the ManjaLink Card will be displayed in the ManjaLink Self-service machine upon tapping the ManjaLink Card on it. The ManjaLink Account Holder can check the TCr balance of their ManjaLink Account via the ManjaLink website.

6. Eligibility

– This campaign is open to the general public who successfully make a remittance via the eRemit Singapore mobile application between June 24, 2024, and December 23, 2024.

– Customers below 18 years old must obtain a consent from their parents or legal guardians before participating in this campaign.

7. Campaign Period

– The Campaign begins on June 24, 2024 until December 23, 2024 (hereafter “Campaign Period”).

– The Organizer reserves the right to vary, postpone or reschedule the dates of the Campaign Period at its absolute discretion.

– The Organizer may terminate or suspend the Campaign at any time at its absolute discretion.

8. Disqualification

– The Organizer reserves the right to disqualify any Customer if they had attempted to undermine the operation of the Campaign by fraud, deception, or cheating.

– The Organizer reserves the right to disqualify any Customer at any stage of the Campaign Period if (i) the Customer is ineligible; (ii) if the Customer breaches these Terms and Conditions and/or (iii) if there are violations of any applicable laws or regulations.

9. Campaign Mechanics

– For existing ManjaLink users:

Customers must download the eRemit Singapore mobile application, set up an account, enter their ManjaLink Card ID in the application, and make a valid remittance using the application during the Campaign Period. The 15 free Travel Credits (TCRs) will be automatically credited to the Customer’s ManjaLink Card within 7 working days once the above steps have been completed.

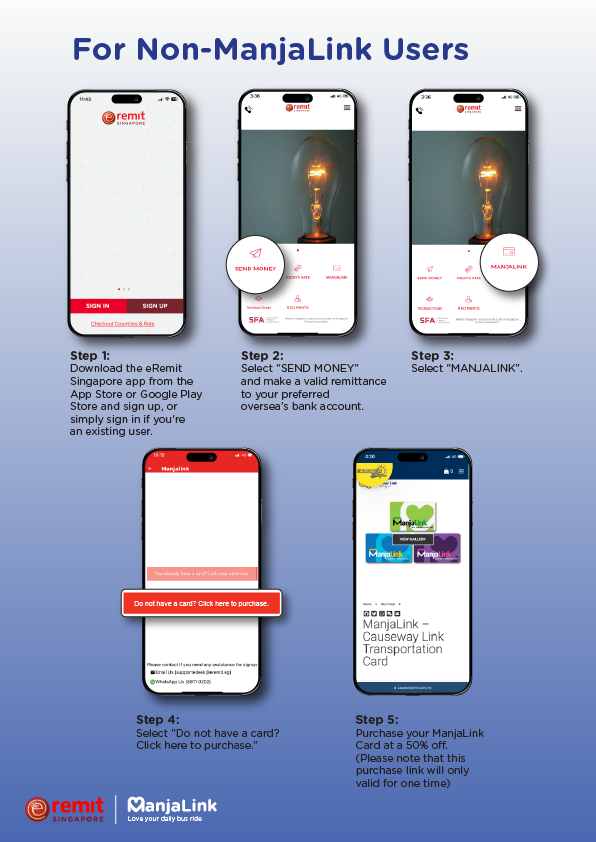

– For non-ManjaLink users:

Customers must download the eRemit Singapore mobile application, set up an account, and make a valid remittance using the application during the Campaign Period. Once these steps have been completed, Customers will receive a unique purchase link in the application to purchase the ManjaLink Card at a 50% discount. The unique purchase link will be available only once, and each Customer is limited to purchasing one (1) ManjaLink Card.

– Customers which have made remittance transactions prior to the Campaign Period or after the Campaign Period will not be eligible for this Campaign.

– Each Customer shall only be entitled to only one (1) offer: either the 50% discount on a ManjaLink Card purchase or the 15 free Travel Credits (TCRs).

– Customers agree to abide by these Terms and Conditions.

– Decisions made or determined by the Organizer are considered final and binding on all matters pertaining to the Campaign.

– Non-compliance to the Terms and Conditions within the Campaign Period may result in disqualification.

– Customers shall grant the Organizer all necessary permissions and/or approvals to use the customer’s name, photos and likeness for advertising and promotional purposes without any compensation whatsoever unless prohibited by applicable law.

– By participating in this Campaign, Customers and/or their respective parents or legal guardians hereby release, discharge and hold harmless the Organizer, its subsidiaries, affiliates, directors, officers, employees, partners and agents from all liabilities, costs, injuries, loss, or damages of any kind arising from or in connection with this Campaign.

– All materials including the photos, artworks used in this Campaign shall become the sole property of the respective Organizer (as applicable). [SK7]

– ManjaLink reserves the right to send SMS messages, email notification or call the Customer and/or their respective parents and or legal guardians pertaining information regarding the mechanics as well as announcement about the Campaign.

– The invalidity, illegality or unenforceability of any terms hereunder shall not affect or impair the continuation in force of the Terms and Conditions of this Campaign.

– The Organizer reserves the right to change, amend, delete or add at any time the Terms and Conditions including mechanism of this Campaign at its absolute discretion.

10. Data Privacy

– This campaign shall comply with Act 709 Personal Data Protection Act 2010 Published On 10th June 2010.

Navigating Cross-Border Transactions in the Digital Age

Navigating Cross-Border Transactions in the Digital Age

In today’s interconnected world, sending money across borders has become an essential part of our global economy. Whether you’re an expat supporting family back home, a business engaging in international trade, or a traveler managing finances abroad, understanding how to navigate cross-border transactions is crucial. Let’s explore the landscape of international money transfers in the digital era.

The Rise of Digital Platforms

Gone are the days when international money transfers were solely the domain of banks and traditional wire services. Digital platforms have revolutionized this space, offering faster, cheaper, and more convenient options. Mobile apps and online services now allow users to send money globally with just a few taps on their smartphones.

Key Benefits of Digital Cross-Border Transactions:

1. Speed: Transfers often complete within minutes or hours, rather than days.

2. Cost-Effectiveness: Lower overhead means reduced fees for users.

3. Transparency: Real-time exchange rates and upfront fee structures.

4. Convenience: 24/7 access from anywhere with an internet connection.

Understanding the Technology

Behind these seamless transactions lies a complex network of technologies. Many modern platforms utilize blockchain technology, ensuring secure and traceable transfers. Others leverage partnerships with local banks and financial institutions to facilitate rapid money movement across borders.

Navigating Regulatory Landscapes

While technology has simplified the process for users, companies operating in this space must navigate a complex web of international regulations. Anti-money laundering (AML) and know-your-customer (KYC) requirements vary by country, necessitating robust compliance measures.

For users, this often translates to a one-time verification process when setting up an account. While it may seem cumbersome, these measures protect both the sender and recipient from fraudulent activities.

Choosing the Right Service

With numerous options available, selecting the right cross-border transaction service can be daunting. Consider these factors:

1. Transfer fees and exchange rates

2. Speed of transfer

3. Availability in your desired countries

4. Security measures

5. Customer support options

6. User interface and ease of use

The Future of Cross-Border Transactions

As technology continues to evolve, we can expect even more innovations in this space. Central Bank Digital Currencies (CBDCs) and further integration of blockchain technology may reshape the landscape of international money transfers.

Conclusion

Navigating cross-border transactions in the digital age offers unprecedented convenience and efficiency. By understanding the technology, regulatory environment, and available options, you can make informed decisions about your international money transfers. As we move further into the digital era, staying informed about these developments will be key to managing your global financial needs effectively.

eRemit is a cutting-edge digital platform designed to simplify money transfers. Our user-friendly app allows you to send money quickly, securely, and cost-effectively.